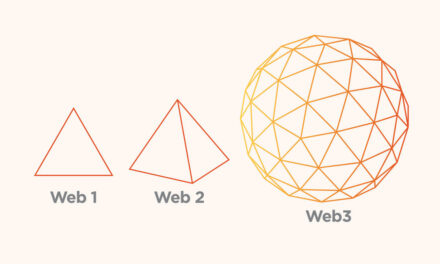

The U.S. Internal Revenue Service now requires payment apps like PayPal and Venmo to report all transactions for goods and services totaling at least $600 as part of the America Rescue Plan. (Fox 19 Now)

Tilt Take: Your business revenue accessed through payment apps always needed to be reported on your taxes. Now, the IRS will know if you don’t.