In conversations among content creators and content entrepreneurs, NFTs have become a common topic this year. Some believe we are in an NFT bubble or others say NFTs aren’t really valuable things. My position? NFTs could be on the precipice of an entirely new business model for content creators.

#NFTs could be on the precipice of an entirely new business model for content creators, says @JoePulizzi. #ContentEntrepreneurs #CreatorEconomy Share on XBut before that can happen, more creators and entrepreneurs have to understand the NFT conversation and how it could potentially become a valuable business model for them. I’ll share a definition, how NFTs work, and how some creators already are adopting NFT business models.

What is an NFT?

NFT stands for non-fungible token. Non-fungible means the token is one of a kind. They represent the digital rights to assets such as audio, video, photos, and more. In this case, the word “represent” is an important denotation. For example, let’s say you buy an NFT for a JPEG on Opensea, the largest NFT marketplace. You aren’t really buying the JPEG; you are buying the token, which may include the rights to the artwork or the information inside it. You receive a certificate of ownership that can be verified publicly on the blockchain.

NFTs represent the digital rights to an asset such as audio, video, images, which can be bought, sold, and verified publicly, explains @JoePulizzi. #CreatorEconomy Share on XLet me pause a moment to distinguish between an NFT and fungible tokens (also known as community or social tokens). We at The Tilt use fungible tokens. Each $TILT coin can be traded in for another $TILT, and they both have the same value. The same goes for fungible currency like dollars, yen, or Bitcoin. A dollar is a dollar. A yen is a yen. A bitcoin is a bitcoin.

NOTE: Theoretically, all currencies are NFTs, but we treat them as fungible. For example, all dollars have a unique reference number. Still, we don’t find it worthwhile to trade dollar bills with someone.

So why would someone pay for an NFT when they (and others) can just right-click, save, and use the JPEG? Because they see it as an investment – they can sell their rights to that digital asset, which could go up (or down) in the marketplace, or the NFT has some kind of utility important to the buyer.

Now, unlike other investments, a “smart contract” can accompany the NFT. This means that the token is programmable and can actually do something. For example, the NFT creator might include in the contract that they receive a royalty every time the NFT is sold. That contract is embedded in the NFT and can be executed the minute the NFT is sold, depositing the money directly into the creator’s designated account.

NFTs change the business game for creators

NFTs are game-changers for artists and musicians. Finally, they can sell their works directly to a global community. Their new business model cuts out most of the distributors (who typically receive a commission) and lets them deal directly and easily with the customers through marketplaces like OpenSea and Foundation.

Artists like Beeple and Trevor Jones have made millions on their NFT sales. Musicians like 3LAU are designing business models where fans (and ultimately NFT owners) can access exclusive music and tickets to events. Music group Kings of Leon generated millions by selling their new album as an NFT.

But what about content creators like podcasters, authors, YouTubers, and Twitchers?

Millions listen each week to Tom Bilyeu’s motivational Impact Theory podcast. In the past, Tom monetized his audience in traditional ways – sponsorships, paid courses, speaking, and merchandise.

Tom’s audacious mission is for Impact Theory to become the Disney for this generation – a collection of amazing media brands for the next century. He’s using NFTs to get there.

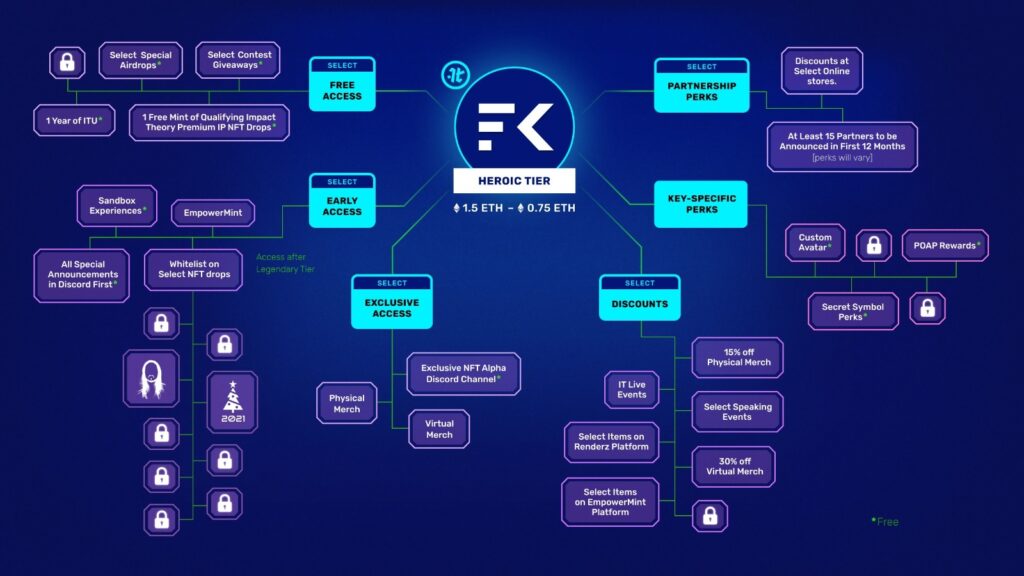

Tom developed Founder’s Key, which dropped in October 2021. He created three NFTs, offering different levels of access. For example, you can purchase the Heroic NFT and get insider access to partnership deals, early access to new projects, discounts on training and merchandise, and tickets to live and virtual events (see Founder’s Key benefit roadmap below.)

While some content creators could mint an NFT for every separate deliverable (event ticket, merchandise discount, insider access, etc.), Tom bundled them into NFT memberships and minted many for each level.

So if you’re a podcaster, you could sell an NFT that creates access to exclusive shows. If you are an author, it could be a book or audiobook. A YouTuber could sell a membership package. A writer could theoretically sell the rights to their articles. For example, on a site like Mirror.xyz, you can create a blog and sell the rights to each individual article. If you have multiple writers, you can set up the page to deliver royalties (through NFTs) on every page. (I think Mirror’s model could work for writers with established audiences. Otherwise, it operates more like a Kickstarter model – support me and own part of my blog.)

A podcaster could sell an NFT that creates access to exclusive shows. A writer could sell NFTs for the rights to their articles. #NFTs #CreatorEconomy Share on XLet’s say you are launching a new event for your fan base. Normally, you’d open registration, sell tickets at different levels, and that would be that. But Gary Vaynerchuk didn’t do that. In advance of his new event VeeCon, he developed the NFT project VeeFriends. VeeFriends are 10K plus pieces of art he created. Each NFT also includes a three-year ticket to VeeCon. Some of the VeeFriends include access to Gary. Some give the owner entry to VIP parties. If you buy one called Gift Goat, you get a special delivery in the mail every month from Gary.

Gary has made millions through this project, with some individual NFTs going for over $500K each. The least expensive three-year ticket will cost you around $40K.

(If you’re wondering why someone might pay $100K for an event ticket, the value isn’t really about the event. The buyers are speculating that their VeeFriend NFT will be worth more down the road, which could happen, for example, if Gary adds more benefits to the NFT or the first-year event does amazingly well.)

Sell your digital intellectual property

What do Beeple, Trevor Jones, 3LAU, Tom Bilyeu, and Gary Vaynerchuk have in common? They are creators who have chosen different ways to sell intellectual property, but all in a way that can be scarce and easily proven.

Scarce because each NFT project created a limited number. When they are gone, they’re gone. If you miss out, you have to buy them for more on the secondary market. Easily proven because ownership can be checked on the publicly accessible blockchain by matching the digital wallet address.

NFTs can work as a business model for creators because they can be scarce (a limited number) and easily proven (verified on a publicly accessible blockchain), says @JoePulizzi. #ContentEntrepreneur Share on XAll that makes the new business model for your intellectual property possible. Never before have you had access to a technology that can so easily sell intellectual property rights from creator to fan (and later fan to fan.)

So, yes, NFTs are a real thing, and no, the bubble isn’t going to burst. Though only a small percentage of people have even experimented with NFTs, adoption is growing quickly and the opportunities are plentiful for content creators.

Check out our Instagram carousel for a visual summary of this post and be sure to follow us at @TheTiltNews.

About the author

Joe Pulizzi is founder of multiple startups including content creator education site, The Tilt and is the bestselling author of seven books including Content Inc. and Epic Content Marketing, which was named a “Must-Read Business Book” by Fortune Magazine. Joe is best known for his work in content marketing, first using the term in 2001, then launching Content Marketing Institute and the Content Marketing World event. He has two weekly podcasts, the motivational Content Inc. podcast and the content news and analysis show This Old Marketing with Robert Rose. His foundation, The Orange Effect, delivers speech therapy and technology services to over 200 children in 34 states.